Morning folks,

Hope you're having a great week! Yesterday the big question was if we’d maintain balance conditions or breakout. I had my suspicions, and took a few tape signals short on NQ. ES would have made the better focus, unfortunately, but it was clear NQ would eventually catch up. I wrote on X to keep an eye on the 23180-200 region, which is where we eventually sold off towards close and caught up with ES to some degree.

With CPI now in the rearview mirror, our focus shifts to today's less impactful PPI data and the VIX expiration. The main takeaway? We're leaning bullish, and those critical levels we identified earlier are now acting as solid support

Diving into the Details: What's Happening Now?

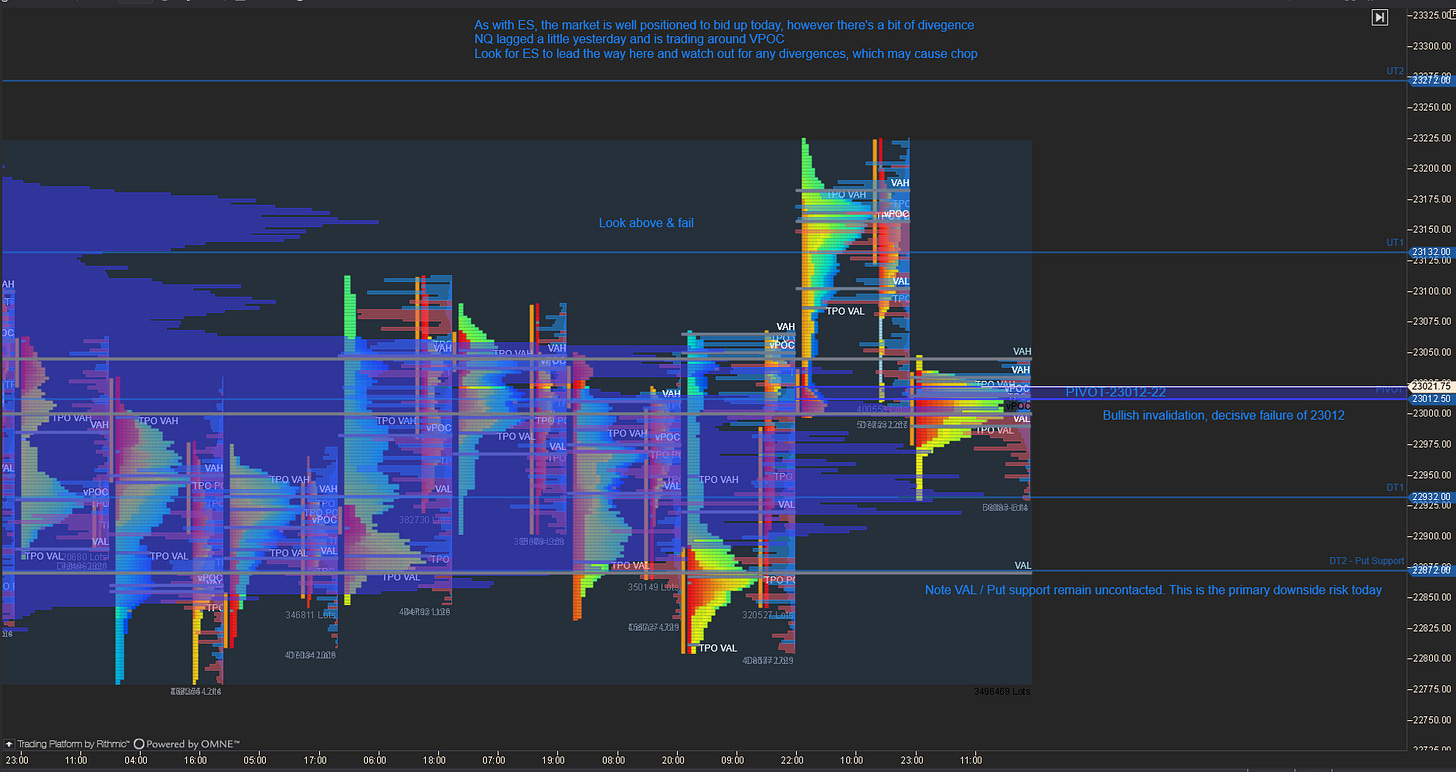

At the time of writing, the SPX spot price is currently sitting at 6243, with ES futures at 6284. For the tech-heavy NDX, we're at 22849, and NQ futures are at 23021. The VIX is at 17.17, which is right on its All-Expirations Put Support level. This means volatility is being kept in check, creating a stable environment for stocks to potentially move higher.

What This Means for Today

Because the market held up so well, our trading plan is now less about reacting to a big event and more about confirming the support that's already been established. For ES, the 6281-6286 zone is our key pivot – which we’re currently holding at time of writing (PPI is just released, which probably has moved us away from here). For NQ, the 23012-23022 area is holding strong as support. Our primary scenario remains a bullish continuation. As long as these levels hold, we're looking for the market to rotate higher, potentially targeting ES ~6301 and ~6326, and for NQ, ~23132 and ~23272. Of course, we always have a contingency plan if things go south, but right now, the odds are clearly in favor of the bulls. VIXperation historically can mean turning points for markets, so I think we’ll see a breakaway from balance going into the end of the week, so stay sharp. But for today, the plan is fairly clear.

Levels wise, there wasn’t much to work with yesterday, and it was a case of going with the flow. Not every day has to be a trading day, there’s often subconscious pressure to turn every move into profit— and as discretionary traders, the best tip I can give you is make a plan pre-market and try to stick to it. Once you start going off-piste, then, lack of confidence can creep in and lead to a cascade of bad decisions. Been there many times- who hasn’t. Some days like this Monday, our levels will and targets will be respected perfectly, and this is what we strive for every day. Hopefully some readers caught the move down from the pivot later in the session into the downside targets. As for my own trading, I was long on DT1 during the London hours, so anything extra is a bonus today.

Trade Safe

-Z

.