Morning folks, keeping this brief as I want to get this out before CPI and also focus on the markets.

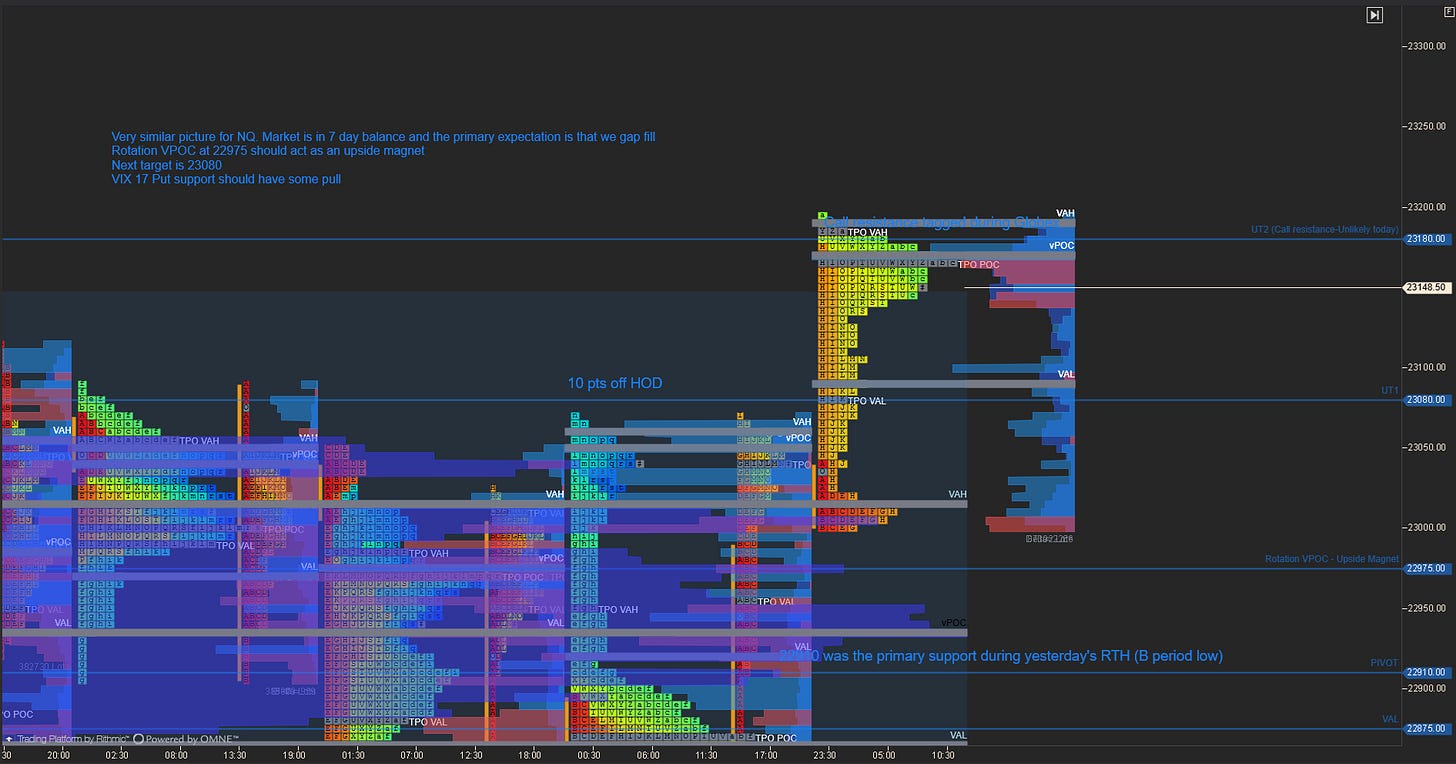

Yesterdays levels worked a treat, tagging the two final upside targets this morning during Globex. We've been watching NQ closely, and it’s already blasted past a major resistance level at 23000. That's a huge deal because it suggests a "gamma squeeze" might already be happening. Charts attached to recap.

What's Next? Breakout or Return to Balance?

So, what does this mean for us? For NQ, the big question is if the breakout will stick or fail. We’ll only know after the print— typically we don’t trade until we see the reaction, and wait for the cash hours, where positioning may change. Keep a close eye on the VIX. It's currently sitting at 16.88, just below a key put wall at 17. If the VIX pops above 17, it's a strong signal that this NQ rally might be running out of steam.

Your Game Plan for Post-CPI Action

Trading right into the CPI announcement is pretty risky, so this plan is all about reacting after the news hits. For the S&P 500 (ES), watch the 6300-6310 zone – holding above it is bullish, below it is bearish. For the Nasdaq (NQ), the 23000-23050 zone is now our key support. If NQ can defend that level after the CPI data, we could see targets of 23250 and even 23350-23400. But if it breaks down, watch for moves back to 22750-22800 or even 22550-22600. Remember, managing your risk around that NQ support level is going to be incredibly important today.

Let us know your thoughts on the markets today in the comments. Breakout or fail? Watch for updates here and on X.

Trade Safe

-Z