The Pre-Market Report Thursday, 17 July

Retail Sales & Unemployment. Coiled tight and poised for breakout?

Hey Traders,

Dramatic drop yesterday on VIXperation, apparently triggered by Trump threatening to fire JP. The dive coincided with a bounce from the VIX 17 put support we keep banging on about, and longs were invalidated below the ES Pivot. Things quickly turned around, responsive buyers stepped in and we remain in a multi day balance. Tomorrow is a huge options expiration day (OPEX). The market has mostly shaken the drop off, but now we're stuck in a bit of a tug-of-war. What's interesting is how options dealers are positioned – they're basically set up to keep things calm within a specific range, but it's a tense calm. We're also seeing a little bit of a divergence between the S&P 500 (SPX) and the Nasdaq (NDX). SPX is chilling comfortably above its main support. NDX, on the other hand, is bumping right up against a major call wall, keeping things capped for now This could mean tech stocks are taking a breather, or just that they've reached a key decision point before the rest of the market. VIX looks pretty bullish today.

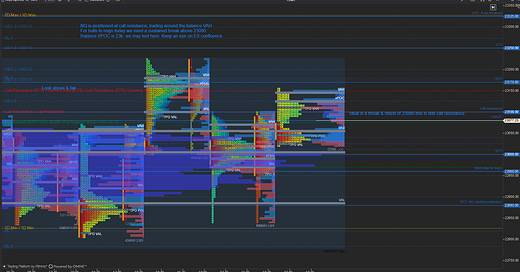

So, let's break down those key levels for the S&P 500 futures (ES) and Nasdaq futures (NQ). For ES, watch out for the 6300 area (around ES 6340) as a big hurdle on the upside – that's our Call Wall. On the flip side, the 6250 area (ES 6290) is solid support, a place where buyers should step in. If we dip below 6235 (ES 6275), that's our VolTrigger and a sign things could get dicey. For NQ, it's all about that 22900 area (NQ 23070). We're basically right on top of it, and it's a massive resistance point. If NQ can punch through and hold above this, that's a big bullish signal. Below that, 22800 (NQ 22970) is our key support.

Looking ahead, all eyes are on the upcoming Retail Sales and Unemployment data – that's probably what's going to break this stalemate. If the data comes in strong, we're likely looking at a bullish continuation. For ES, that means buying dips around 6290-6298, targeting 6340. For NQ, we need a confirmed breakout above 23080 before even thinking about going long. If the data disappoints, or we get some unexpected headlines, we could see a bearish reversal. In that case, watch for ES to break below 6275 for potential short entries, and NQ could reject sharply from its 23070-23100 resistance. All in all, the path of least resistance feels higher, thanks to the VIX and SPX. But NQ is at a make-or-break point.

Trade Safe

-Z