Keeping things fairly brief today - we have a ‘quadruple whammy’ of quarterly OpEx, FOMC, VIXperation, as well as contract rollover. For today I’ll continue to use M5 but probably switch to U5 by tomorrow. Liquidity on the book is already much thicker on U5 so, I’m still deciding here but, I’m not expecting any major breakouts so unlikely to enter any swing positions.

We begin the week in a state of high tension and notable divergence. The fear from last week's geopolitical events has not fully subsided, as evidenced by a very elevated VIX. While the broader market (SPX/SPY) is attempting to find its footing at a critical support pivot, the tech sector (NDX/QQQ) remains in a structurally weaker position. The VIX's behavior around its own key pivot will be the deciding factor for the market's direction today - that pivot is 19.5, similar to Friday. 19.5 is the line in the sand, above is bearish for indices, below bullish. The 0DTE chart shows a conflict between the Negative GEX below 19.5 (which wants to pull VIX lower) and the Positive GEX above, especially at the 20.00 Call Resistance (which wants to pull VIX higher).

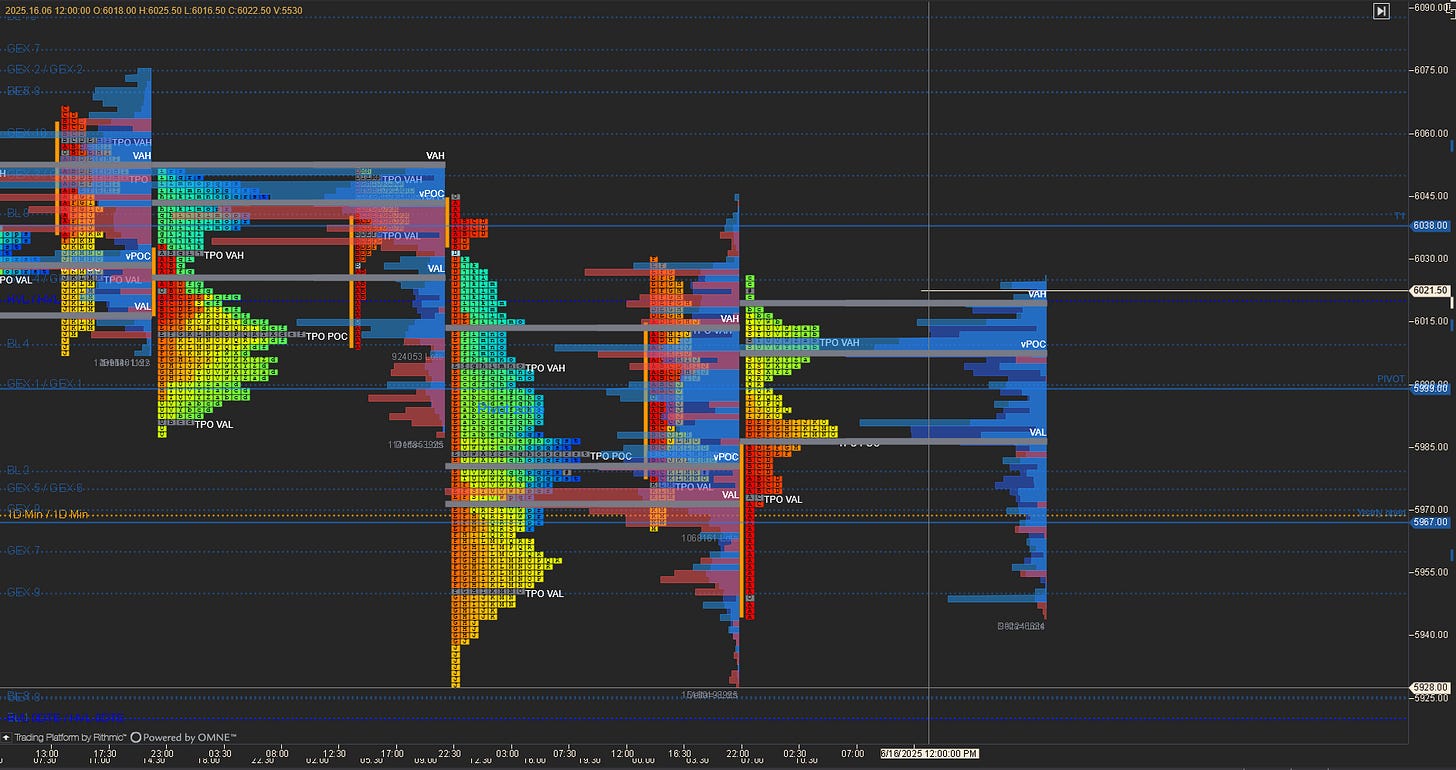

For ES:

Holding the Pivot: SPX at 6014 is trading just above its 0DTE HVL of 5990.

Constructive but Cautious: This is a constructive position. By holding above this key pivot, the SPX is in a supportive Positive Gamma environment. This means dips should be cushioned, and the structure favors a move higher.

ES 5999 is the pivot for the day. If we can hold there, the path is open to rally towards the major 0DTE GEX concentrations at SPX 6050 / ES 6054. A break of 5999 could see a revisit of yearly open 5970. I’m expecting a bit of a choppy day so, I’d keep targets modest.

For NQ:

The environment for NQ is more tenuous than for ES. It is the weaker link and needs confirmation from the broader market and VIX to sustain a rally. The entire session for NQ hinges on its ability to reclaim and hold above the NDX 21790 / NQ ~21805 HVL. For this to happen, we would need to see the VIX fall decisively below 19.5. If that occurs, NQ could successfully break out above its ~21805 pivot. This would open the path for a rally towards the next major GEX concentrations at NDX 21950 / NQ ~21965 and the NDX 22100+ area.

If the VIX holds firm above 19.5, it will be very difficult for NQ to break out. A rejection from the ~21805 pivot would be a high-probability outcome, risking a move back down into the negative gamma zone to re-test the lows from last week around NDX ~21500-21600 / NQ ~21515-21615. I’ve marked the Friday/Monday ETH VAL as DT1- given the market is forming a short term balance in the LVN from Friday’s drop, this seems like a reasonable target (around 21600 NQ)

.Trade safe

-Z