I thought it would be useful to just describe the trades I actually take in these recaps, and why I don’t take others.

Sometimes the reason for not taking a trade is hesitation in the moment, conflicting ideas in your head- if you’ve been trading these markets for any amount of time, you will surely know the feeling.

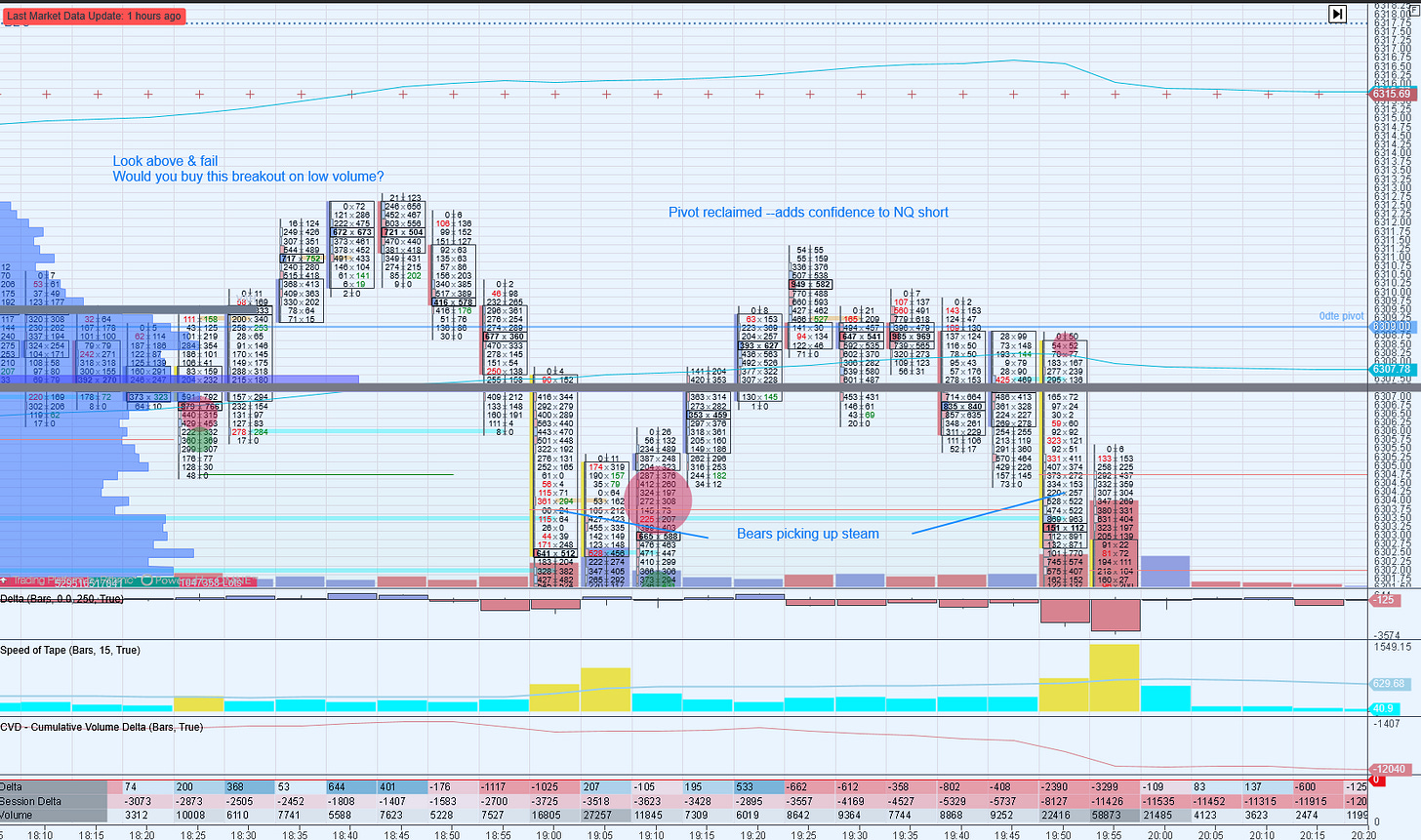

Definitely a bit of a tougher session with a lot of chop-but our levels were respected well. After the dramatic fall overnight, I was expecting the market would catch a bid as we were hovering around the multi-day balance VPOC on ES, and VAL on NQ. So, some responsive buying is expected. The wildcard here was the large negative GEX on NQ sowing some doubt, especially with the weak low left during Globex— the market loves to trap both sides in the A period (I don’t know why I’m personifying the “composite man” but you get my point), but, ES led the way up to our pivot, where we eventually sold off.

The market handed a gift during Globex, tagging Thursday’s pivot providing the low of the session. I left a limit here and added on at market price after I saw the level was being respected. We had a classic absorption shown on CVD and notably a 140 lot bid accumulated in this area. Looking back, some dynamic position sizing (up) here crossed my mind but, I ended up keeping it fairly light.

Ended up closing this one at VWAP, as I judged the downside risk on NQ too great but, that turned out to be a poor decision as we eventually did contact our main pivot for the session.

After a small short during the A period on NQ, I held out for the pivots where the balance VAH levels were also sitting. After a very long wait, eventually we did get a reasonable sell off in the final hours of the session. It can be quite difficult to hold positions that float in and out of drawdown but the signs were clear, ES was clearly exhausted with CVD dropping off a cliff (the last four hourly candles all had a negative delta), so I took a couple of minis short on NQ and ended my day.

One of the themes in markets I’ve found over the years is analysis is really the easy part, if you have the attention span for say, a 4 year PhD then, that’s about the commitment level you need to master analysis and execution— the only difference is you don’t have the support structure around you, as this is fundamentally a solo performance sport.

What could we have done better? Simply holding the buys on ES was the major ‘kicking myself’ moment but, perfection can never be achieved here. Just need to grab your slice when it presents.

One of the misconceptions newer traders make is that they think they should be able to turn any market move into money. In reality, the best approach is to simply wait and size appropriately when you have a good opportunity. Gauging what and what isn’t a solid, A+ opportunity in the moment and acting on it is truly the hardest part.

Have a good weekend!

-Z